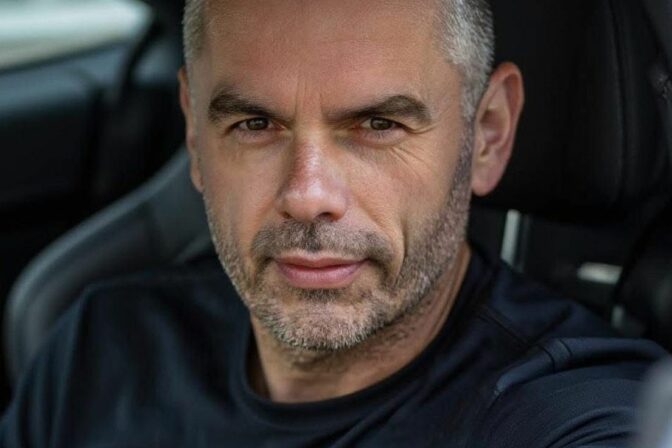

BRATISLAVA, April 10, (WEBNOVINY) – In connection with the planned reform of taxes and payroll levies, Finance Minister Ivan Miklos does not fear that employment will increase; he would be more afraid of a collapse of public funds were the reform not implemented. The minister further said in a political debate program of the public-service Slovak Television O 5 Minut 12 that the reform in its current form will mean ten million euros less from self-proprietors to the state budget. The original draft reform counted on twenty million more for the state coffers. “We will have fewer revenues, so we will have to reduce spending,” Miklos stated. The debate on the reform within the coalition partners has taken four months. In the next two weeks, the Finance Ministry is expecting proposals from the public. By the end of the month, the draft reform should be presented to the Cabinet. The project will require a number of changes in related laws. Miklos mentioned mostly formal changes in 170 laws.

The finance minister specified that most self-proprietors would pay less in social and health insurance contributions, while those who had large incomes and deducted forty percent of their income in expenditures would pay more. The tax and levy burden would moderately decrease, the minister underscored. It will increase only to a portion of self-proprietors and one-fifth of contract agents. “Real” self-proprietors will be able to deduct more items in expenditures.

The reform will also introduce a super-gross wage. The super-gross wage was introduced in the Czech Republic, too, but it is about to be abolished. The reason for that is that they had a half-reform, Miklos commented. He believes that the Slovak tax reform works great, while “in the Czech Republics it blows in many areas”. The minister concluded by saying that introduction of the super-gross wage in Slovakia should not cause the same reactions as in the Czech Republic.

SITA