BRATISLAVA, October 19, (WEBNOVINY) — Lawmakers will no longer debate draft bills related to the tax and payroll levy reform at the ongoing parliamentary session. Based on an agreement of deputy clubs, MPs voted on Wednesday to approve dropping the Cabinet draft bill on income from dependent activities and the related constitutional amendment from the program of the 24th session of parliament.

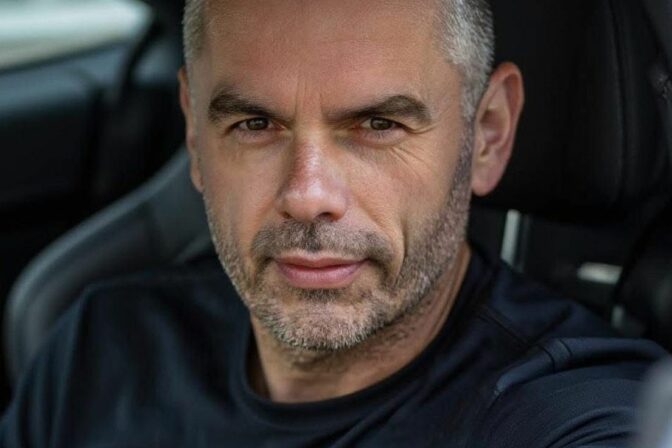

Minister of Labor and Social Affairs Jozef Mihal informed on the withdrawal of the tax and payroll levy reform last Thursday, after the Cabinet’s session. He expressed regret for it, saying they have been working on the reform for over a year and it would have been beneficial for the people. Mihal sees no chance for any draft bill that would significantly influence events in Slovakia to be passed. “No substantial proposal can be expected to be passed in parliament apart from the state budget bill,” added Mihal.

Based on the now abandoned reform plan, as of next year, the super-gross wage was to become the calculation base for taxes and health and social insurance contributions. The super-gross wage was to be the employee’s gross wage increased by payroll contributions paid by the employer, except for accident insurance contributions. The changes were to bring about one health insurance and one social insurance contribution and a uniform calculation base for taxes and health and social insurance contributions. The health insurance contribution was to be 9 percent of the calculation base with the exception of persons with disabilities, who would pay a half of the rate. The rate for paying social security contributions for employees was to represent 19 percent, for self-employed tradesmen 13 percent, and for contract agents 10 percent. Flat-rate expenditures of 40 percent of income that the self-employed can deduct from their tax base should have been replaced by a cap of approximately EUR 200 a month, which is the minimum subsistence level. The non-taxable part of the tax base was to come down from 19.2-fold to 18-fold the subsistence level for all taxpayers.

SITA