BRATISLAVA, October 14, (WEBNOVINY) — Organizations representing employers in Slovakia are calling on parliamentary political parties to approve the draft state budget for next year along with the related tax and payroll-levy reform in order to prevent a provisional budget. “In spite of the tense political situation, we are asking political parties not to resign on changes that significantly improve the business environment and that will considerably influence future economic development and jobs in Slovakia,” reads a joint statement of the National Association of Employers (RUZ), the Federation of Employers‘ Associations of the Slovak Republic (AZZZ), the Slovak Chamber of Commerce and Industry and the Club 500. Employers express support to the prepared reforms, that are to have major impact on making the tax and payroll levy system more transparent, simpler, as well as reduce red tape and administrative burden of employers as well as the self-employed.

Employers point out that the reforms have a potential to increase the competitive strength of Slovakia, the number of work positions as well as the standard of living of Slovak citizens. In particular at times of a continuing global economic crisis, the support for local business sphere and new foreign investments is of uttermost importance. According to them, stable public finances, squeezing the deficit and preventing growing indebtedness are essential from the viewpoint of maintaining employment, quality of business environment and the living standard of Slovak citizens.

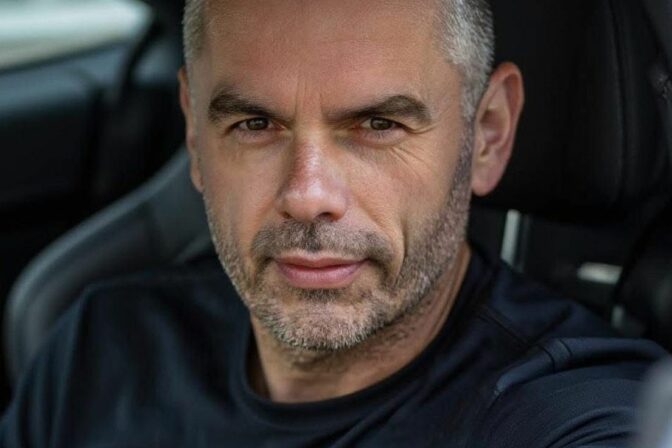

Outgoing Minister of Labor and Social Affairs Jozef Mihal opines that the tax and payroll levy reform is over. He expressed regret at Thursday’s Cabinet session, saying they have been working on the reform for over a year and it would have been beneficial for people. Mihal sees no chance for any draft bill that would significantly influence events in Slovakia to be passed. “No substantial proposal can be expected to be passed in parliament apart from the state budget bill,” added Mihal.

In the tax and payroll-levy reform, as of next year, the super-gross wage was to become the calculation base for taxes and health and social insurance contributions. The super-gross wage was to be the employee’s gross wage increased by payroll contributions paid by the employer, except for accident insurance contributions. The changes were to bring about one health insurance and one social insurance contribution and a uniform calculation base for taxes and health and social insurance contributions. The health insurance contribution was to be 9 percent of the calculation base with the exception of persons with disabilities, who would pay a half of the rate. The rate for paying social security contributions for employees was to represent 19 percent, for self-employed tradesmen 13 percent, and for contract agents 10 percent. Flat-rate expenditures of 40 percent of income that the self-employed can deduct from their tax base should have been replaced by a cap of approximately EUR 200 a month, which is the minimum subsistence level. The non-taxable part of the tax base was to come down from 19.2-fold to 18-fold the subsistence level for all taxpayers.

SITA