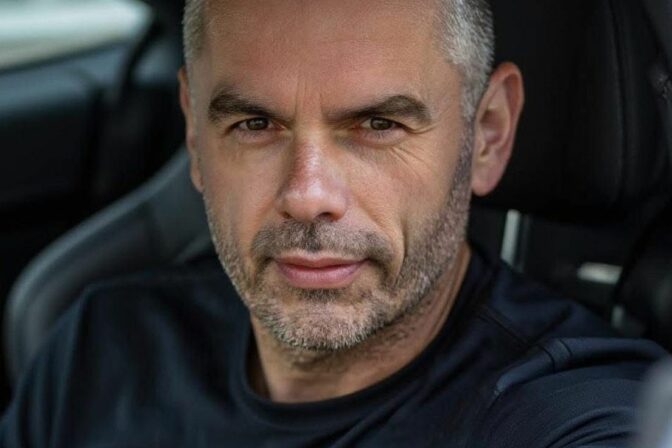

BRATISLAVA, January 19, (WEBNOVIN) — The capacity of the temporary European rescue mechanism should be sufficient for the ongoing loan programs even after its rating has been downgraded and its lending capacity was thus reduced, believes Slovakia’s Finance Minister Ivan Miklos. “I expect that even after this downgrading it should still be sufficient for currently running programs and I expect that it should be enough until July, when the European Stability Mechanism comes into effect. From this viewpoint it must not be necessarily a problem unless some new necessary big programs emerge, the minister told a news conference on Thursday.

However, it is questionable whether after the downgrading of the bailout fund’s rating, pressure does mount on increasing funding in the permanent rescue mechanism that is to be launched in July of this year. Miklos admitted that the S&P rating agency move can play into the hands of those who support a hike in sources. “It is certainly true that it will likely strengthen arguments of those who fight for a higher lending capacity. I would not like to take a categorical stance on it but if possible it would certainly be ideal if we do not have to hike it,” said Miklos adding that he first needs to see analyses and calculations given the rating’s downgrade.

Standards & Poor’s downgraded ratings of Slovakia and other seven eurozone countries last Friday. One Monday, the agency also downgraded the credit rating of the European Financial Stability mechanism by one grade from the highest AAA rating to AA+. The agency says that the rescue mechanism can win back its highest rating if its shareholders succeed to enhance its lending capacity.